The foundations of modern specialty (re)insurance

Build your future placement and underwriting strategy with Artificial's pioneering technology.

Transform your placement and underwriting strategies

Artificial gives you the power to navigate a changing specialty risk transfer landscape.

Empower your team

Unlock the full potential of your team by enabling them to focus entirely on broking or underwriting.

Improve performance

Make smarter, more informed decisions with access to more high-quality, actionable data.

Reduce costs

Simplify the complexities of the specialty market with automation, reducing operational overhead.

TRUSTED BY some of THE WORLD’S BEST INSURANCE COMPANIES

Our solutions

Our toolkit delivers precise, rapid and cost-effective solutions to the most complex challenges faced by brokers and carriers.

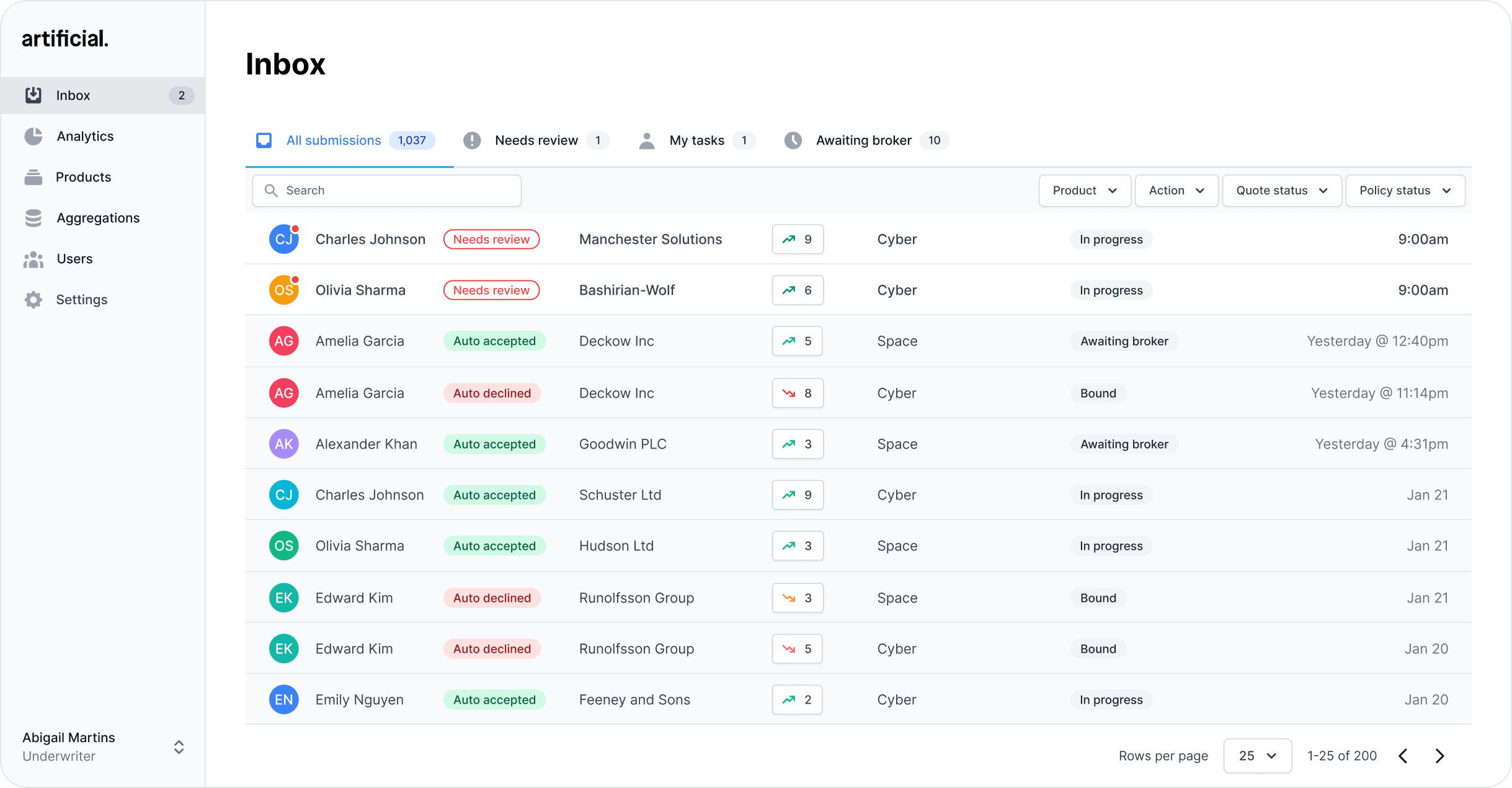

Smart Underwriting

Our configurable platform enables carriers to deploy underwriting capital to lead and follow opportunities in the most effective way through digital underwriting.

Smart Placement

We remove the operational complexities of evolving placement strategies for brokers and empower them to make the most of their scale and leverage.

Loved by our customers

“Our focused collaborative relationship with Artificial enables us to continuously strive for ongoing enhancements and developments of the [BMS Group] platform.”

Passionate about the future of insurance

The orchestra model: Building connected ecosystems in insurance with Adam Masojada

In this episode, Adam Masojada, Chief Ecosystem Officer at Accelerant, explores what a truly connected insurance ecosystem looks like and why it matters now more than ever.

From momentum to maturity: Artificial's next phase of growth

InsTech’s packed ‘Some Lead, Others Follow: Smart Underwriting and Broking Strategies for 2026’ event kicked off the year with a focus on digitisation and changing London market insurance dynamics.

Artificial Labs raises $45M Series B to accelerate global growth

London, UK, 3 February, 2026: Artificial Labs (Artificial), the leading provider of digital broking and underwriting technology for the specialty and commercial insurance markets, today announced the completion of its $45 million Series B funding round.

Want to learn more?

Book a chat with us today to discover how our technology could help transform your specialty (re)insurance business.

We and selected third parties use cookies or similar technologies as specified in the cookie policy. Learn more