The foundations of modern specialty (re)insurance

Build your future placement and underwriting strategy with Artificial's pioneering technology.

Transform your placement and underwriting strategies

Artificial gives you the power to navigate a changing specialty risk transfer landscape.

Empower your team

Unlock the full potential of your team by enabling them to focus entirely on broking or underwriting.

Improve performance

Make smarter, more informed decisions with access to more high-quality, actionable data.

Reduce costs

Simplify the complexities of the specialty market with automation, reducing operational overhead.

TRUSTED BY some of THE WORLD’S BEST INSURANCE COMPANIES

Our solutions

Our toolkit delivers precise, rapid and cost-effective solutions to the most complex challenges faced by brokers and carriers.

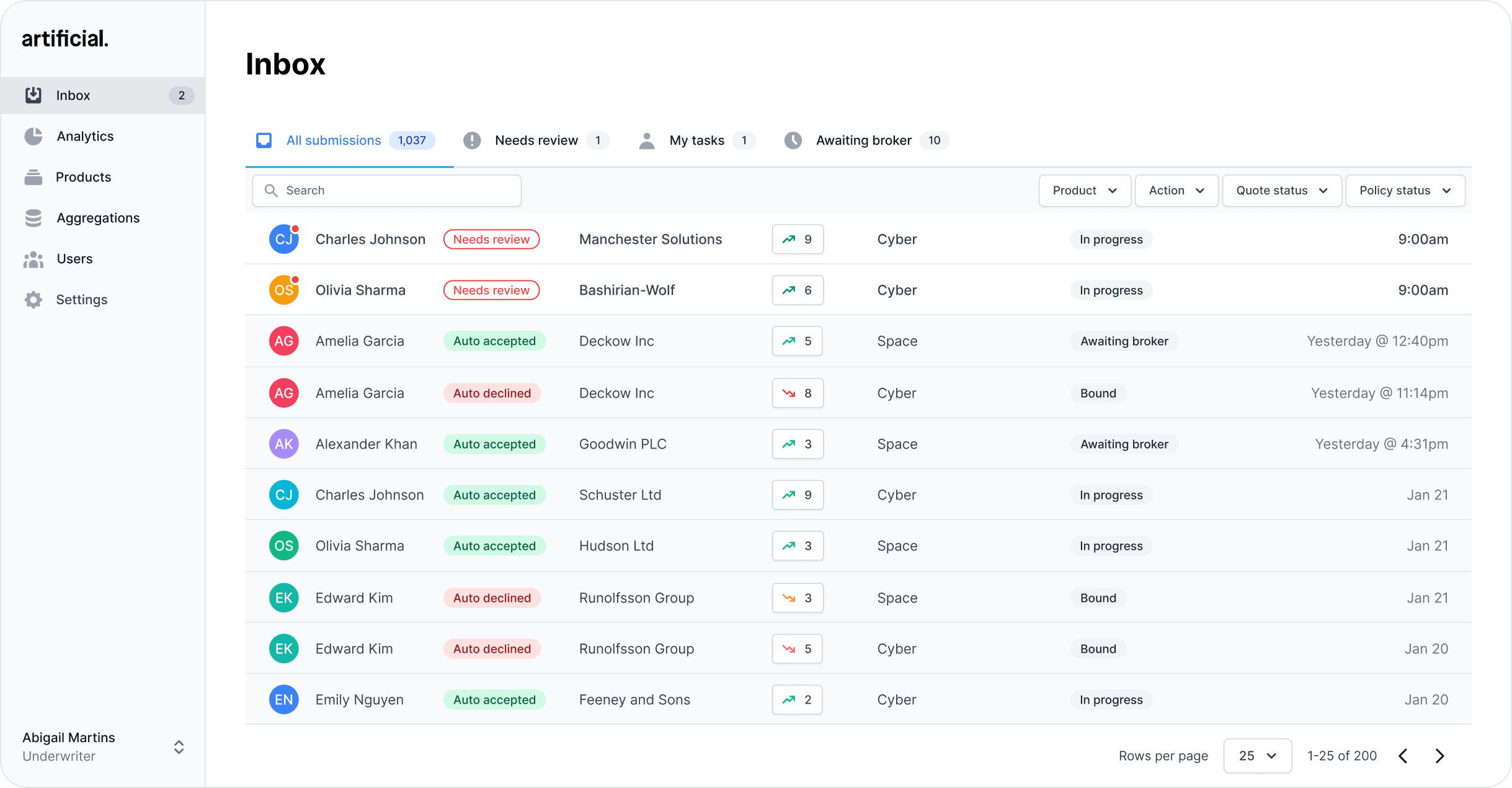

Smart Underwriting

Our configurable platform enables carriers to deploy underwriting capital to lead and follow opportunities in the most effective way through digital underwriting.

Smart Placement

We remove the operational complexities of evolving placement strategies for brokers and empower them to make the most of their scale and leverage.

Loved by our customers

“Our focused collaborative relationship with Artificial enables us to continuously strive for ongoing enhancements and developments of the [BMS Group] platform.”

Passionate about the future of insurance

Artificial and PPL integrated Digital Contracts: what's new and what it means for brokers

The move towards data-first trading continues to gain momentum, and brokers using Artificial's Contract Builder alongside PPL now have access to a more connected, seamless experience. Recent upgrades to Digital Contracts make the process of creating, validating and sharing compliant MRCs even faster and more consistent, without disrupting existing workflows.

Why claims isn’t boring: technology, trust and transformation with Andrew Pedler

In this episode of Insurance Technology: Fact or Fiction, host Georgie Simister is joined by Andrew Pedler, Vice President at Reserve UK, to challenge the idea that claims is the dull cousin of underwriting and broking.

Why the London Market needs to think beyond underwriting workbenches

The rise of underwriting workbenches in the London Market has been an important step in modernising the sector.

Want to learn more?

Book a chat with us today to discover how our technology could help transform your specialty (re)insurance business.

We and selected third parties use cookies or similar technologies as specified in the cookie policy. Learn more