As well as being a shock to the senses and an event at a scale unlike any other I’ve seen, ITC Vegas was a remarkably insightful experience for this humble marketer.

It can be difficult with a conference of this size to draw out patterns and themes due to the sheer number of panels and demos on offer. But as the days went on, it became obvious to me that key themes were emerging.

And what was even clearer was that the future of insurance is a place where Artificial technology will fit right in - as the ‘glue’ holding carriers, brokers, data providers and most importantly, the customers, together.

Both the panel discussions and conversations around Vegas showed me that data innovation, risk mitigation and sustainability will all be fundamental parts of the industry’s future. The next wave of insurtech - Insurtech 3.0, some have coined it - will be about mitigating risk and improving combined ratios using unprecedented levels of data and insights.

At risk of being overzealous with the metaphors, I believe Artificial can be the engine room that powers this ecosystem for forward-thinking carriers and brokers, all whilst addressing the key issues we heard at ITC and elsewhere this year.

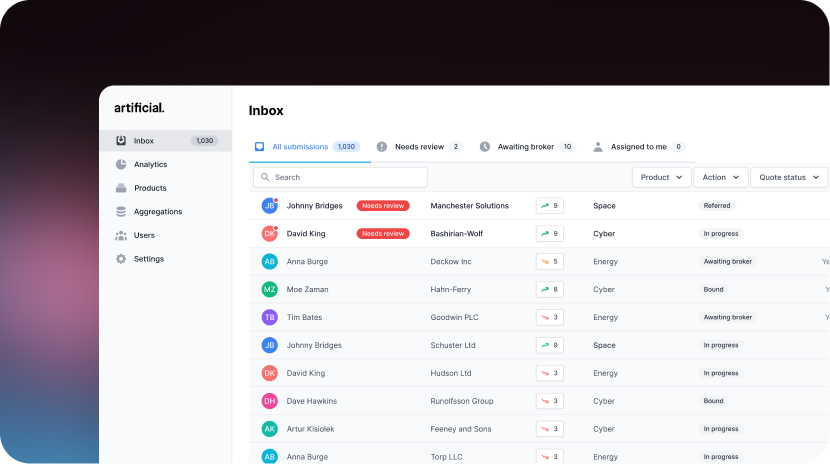

Our platform takes in quality data, underwrites algorithmically, connects with brokers and analyses the portfolio, seamlessly improving the overall insurance lifecycle and powering the next generation of digital insurer.

Theme 1: Data innovations

Insight over information

There seems to be an increasing demand in the global insurance market of not only good quality data but for more innovative ways to use it.

One of the best takeaways from ITC was at the Future of Commercial Sustainability panel hosted on Tuesday by Sabine VanderLinden and Alchemy Crew (featuring our very own COO Deana Murfitt), with the first session of the day dedicated to data analytics and insight.

A quote that stuck with me from the conference is: ‘Smart underwriting is insight over information’. As Jeff Radke from Accelerant also put it on the Insurtech and Risk Management panel on Thursday: ‘No one cares about data - they care about insights.‘

What I gleaned from both talks is that point solutions will not provide sufficient insight for the future insurer.

When a member of the audience informed the panel how data had let down many Australian insureds because of incorrect conclusions drawn from data sets after wildfires and floods, Rosie Smith from McKenzie Intelligence Services offered the following response:

“The insurer bought a flood model and a wildfire model - so why didn’t it work? Because the models didn’t work together. We call it data corroboration intelligence. Geocoding, flood - it’s a corroboration of that. How do I use data set 1 with data set 2? […] As an insurer you’ve got to somehow deal with 20 different point solutions updating at different times and frequencies. Data co-operation is the new world.”

Data co-operation is an interesting term, enforcing the idea of a ‘glue’ that can hold different sources together. Instead of using disparate data sets that work in isolation, our platform combines them into one view for the user in an underwriting workbench where information can be analysed in tandem.

One of our latest projects is an example of this. On the platform, the client can see sanctions checks, clearance, risk data augmentation, CAT modelling and technical pricing all in one place, instead of spending hours searching for each separately.

Finding new patterns

This superior view of both portfolio and submissions can lead to the discovery of previously undetectable trends.

For example, the client may uncover that risks written on a Friday typically have a 40% higher loss ratio. They can then analyse what usually happens on a Friday - is the underwriter tired by the end of the week? Do they have lots of meetings on this day? Do they have weekly targets to hit? From there, the team can take steps to ameliorate submissions written on Fridays.

These are invaluable insights and the kinds of which I believe insurers in the future will take as a given in any digital underwriting platform.

Theme 2: Risk mitigation

Insurance: good, but could it be better?

Another theme I heard a lot about in Vegas was risk mitigation. It’s clear to me that insurers want to use data to prevent risk and improve loss ratios.

Jonathan Jackson from Previsico put it well in the second session of the Future of Commercial Sustainability panel: ‘Up to today, insurance has been about loss - this is good, but can we do better?’

This was further cemented on Thursday’s CUO Fireside chat with Charlotte Halkett, CUO of ManyPets, who said ‘In the next ten years we are moving to prevention […] We don’t have to mitigate loss if it’s prevented in the first place.’

It’s clear that risk mitigation is a prevalent theme for both retail and commercial insurers, but the most stark example of this is for climate-related products such as flood - Build Back Better schemes are already working to prevent flood losses in the UK with great success.

But where do you get the data from and how do you use it to actively prevent loss for other commercial lines?

By using and analysing data effectively from a range of trusted sources, Artificial can reduce potential claim payouts in a couple of ways:

1. Improving risk selection to give better loss ratios

If you have a good grasp of data - even as a new entity without years of historical claims information - you can predict claims more accurately and reduce risk exposure and loss ratios.

Our algorithm can take in as much of the right underwriting data that’s available and use it to codify appetite parameters and portfolio characteristics which generate an algorithm for assessing risks in real-time - leading to a more informed decision by the underwriter.

With improved oversight and understanding of the data, underwriters can also improve and better understand the loss ratio for that risk from a claims point of view.

2. Policy optimisation to offer more customer value

One of the more recent additions to the Artificial platform is what we call a Portfolio View. Why does this matter? Because effective portfolio analysis can help improve oversight between claims and underwriting teams, offer opportunities to tighten coverage and/or increase deductibles, and (most significantly in this context) provide advice to the policy holder to mitigate risks.

Hearing from a wealth of insurers at ITC reinforced the need for data to provide value and insight to the customer, not just the carrier.

With a portfolio view of policies, driven by both market insights and insurer claim data narratives, an insurer can give unprecedented value to the insured. AI can extract meaning from loss narratives to give more detail around the cause of a loss, as well as additional risk factors to consider in the future.

As a rudimentary example, a business owner who has 10 wooden warehouses, only 3 of which have a sprinkler system, could be offered a lower premium if they install a sprinkler system in the remaining 7 warehouses. If one of the warehouses is next to a river or a fire station, the premium could lower even further for that property.

What’s more, having clear and concise data that correctly identifies the insured entities, their locations or insured risk, and finally coverages, enables an insurer to accurately quantify their exposure and aggregations and negate policy clash to avoid over-exposure to loss events.

Theme 3: Sustainability

The last major theme I noticed coming up again and again at ITC was sustainability and ESG.

Insurers are desperately trying to clamour together their ESG credentials as they respond to worsening natural disasters and climate change, as well as the pressure (rightly so) to improve representation across the upper echelons of their businesses.

The social and governance aspects of ESG may be lagging behind climate-related policy but responsible practices are fundamental, if evolving.

Matt Ferguson of Sønr opened the Responsible Underwriting session in the Alchemy Crew panel on Tuesday by arguing that data will have a key role to play in how resilient businesses are in our changing environment.

In the insurance context, ESG really means ‘ensuring the business model can adapt to what is expected to be a very different commercial and social environment over the coming years.’

Our COO Deana Murfitt went on to explain that this is an exciting moment in insurtech because companies like ours can harness this wealth of data for complex risks.

Our philosophy in general is that we will underwrite whatever is in your appetite but algorithmically, i.e. faster and more efficiently. Now, this may mean that an insurer who wants to improve their ESG ratings and automate their commercial line products can do so with an enormous amount of data - and do it a lot quicker and more effectively than was possible before.

There are two benefits here: improved data accuracy for better (that is, more informed) underwriting and a more efficient underwriting process in general thanks to automation - both of which help a business become more resilient.

As fellow panellist Matt Stein from Salient Predictions pointed out, smart insurance companies have already accepted that science is progressing and are recognising it. With any industry there are early adopters, but eventually I believe it will be a given that ESG scoring is built into commercial and specialty products from the start.

Starting the next chapter

There is a great pressure upon our industry to change with the times and be part of a more responsible world. Insurers have the potential to either greatly improve or worsen significant life experiences for all members of society. I think the future of insurance will be awash with better data, provide better experiences for the customer and hopefully be better for the planet.

So now we know what (probably) awaits us, how do we step into this brave new world of Insurtech 3.0?

Whether we’re the glue, the engine room or even the cockpit (final metaphor, I promise), for Artificial, Insurtech 3.0 is already here. We are working with many forward-thinking insurers and brokers who use data ingestion, enhancement and algorithmic underwriting to place and consider risks between each other using only one piece of kit that ties everything together.

All we need from the industry is the continued incentive to progress and the willingness to explore new ways of doing things. Then the future insurance ecosystem will start to take shape.

Want to know more? Get in touch or find us on LinkedIn.