For decades, underwriters had to work across spreadsheets and legacy systems. Workbenches brought structure to this complexity, improving visibility and streamlining workflows.

And for carriers in the early stages of digital transformation, these workbench tools have undoubtedly been valuable; Artificial has been offering workbench capabilities as a module of its underwriting platform for years.

However, their impact has been largely operational. Workbenches have made existing processes more efficient, rather than fundamentally improving or digitising the underwriting process itself.

In today’s market, we don’t believe that’s enough.

The blindspot of underwriting workbenches

The Lloyd’s Market association’s 2024 report, The Growth of Enhanced Underwriting in the Lloyd’s Market, shows that all forms of ‘enhanced’ underwriting already account for billions in GWP. Augmented models, which combine automation with human oversight, are expected to grow at 60% a year over the next 5-10 years.

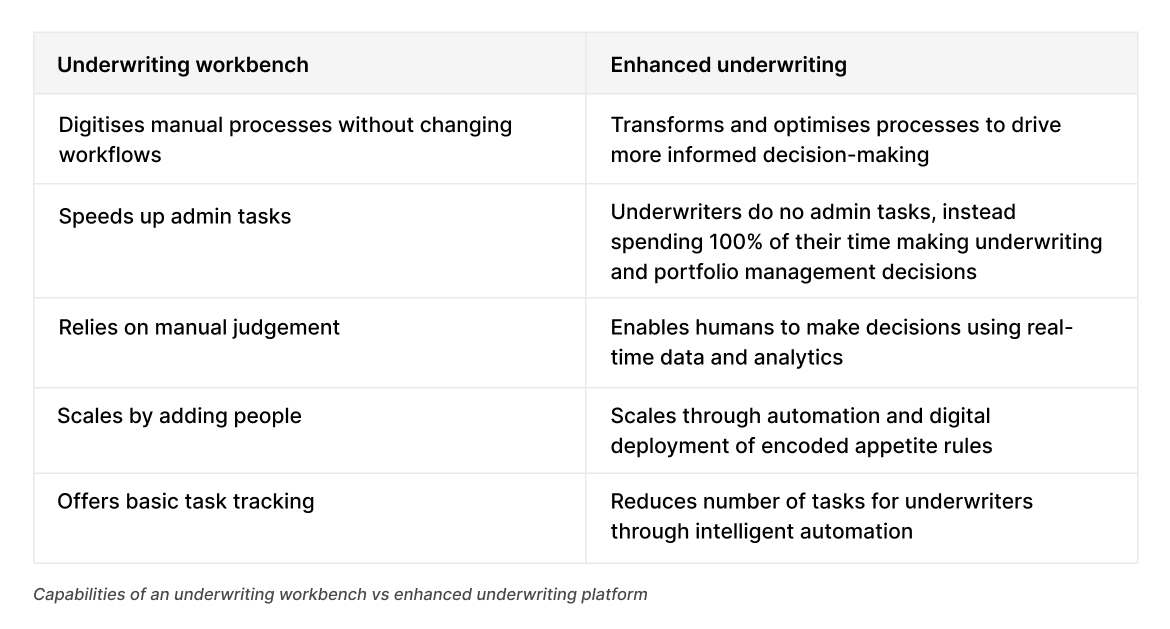

While workbenches excel at digitising human processes like data rekeying, surfacing information and task tracking, they won’t provide a carrier with the tools for true augmented underwriting.

Modern underwriting should be about deploying capital intelligently, responding to your portfolios in real time, and making consistent, data-driven and more accurate risk decisions.

The potential for growth is astronomical, but we cannot be under the illusion that this will be reached with workbenches alone.

Bridging the gap between the workbench and enhanced underwriting

Instead of just moving tasks through a queue, there are several things a true augmented underwriting platform should provide:

Owning your IP and delivering it to distribution by capturing your underwriting appetite digitally and ensuring it is applied consistently in every transaction.

Scalability: Platforms must allow for scaling premium without costly headcount increases.

Speed to market so you can launch a fully digital underwriting product, with integrated pricing and portfolio management, in weeks rather than months.

Real-time portfolio management enables underwriters to respond quickly to market changes and gain competitive advantage in aggregate-sensitive lines.

Improved risk selection from using data to inform forward-looking decisions rather than relying on past, out-of-date analysis.

Differentiation with distribution: Stand out from competitors with increased line sizes, faster responses or access to a broader range of appetite.

Connectivity to broker platforms so you can connect to all existing and future broker systems and transact digitally via API.

Embedded compliance, auditability and controls through immutable audit logs and unconscious compliance mechanisms.

These capabilities are not just operational enhancements; rather, they are the foundations of competitive advantage in a market where margins are under pressure and broker expectations are evolving.

Artificial’s Smart Underwriting rethinks how digital underwriting should look

Artificial’s Smart Underwriting is an insurance underwriting platform designed specifically to support enhanced/digital underwriting. Unlike a workbench, our insurance software doesn’t just digitise how things are done today, it helps underwriters make better decisions tomorrow.

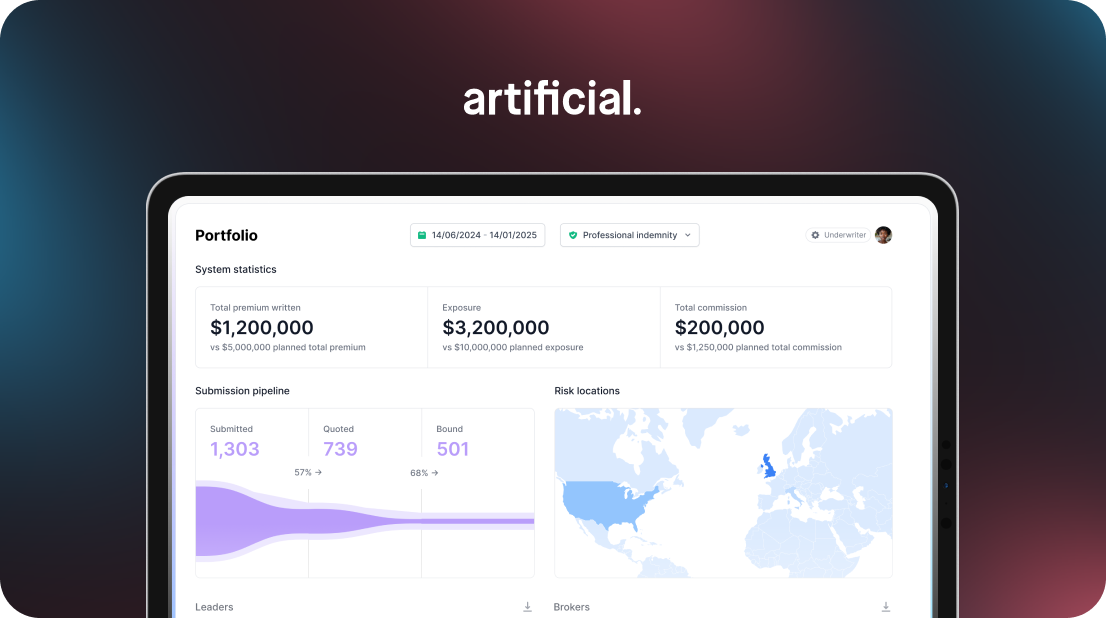

Smart Underwriting toolkit enables underwriters to deploy capital in the most effective and efficient manner and become the most informed portfolio underwriter, in the most efficient way. The LMA report predicts that these models could increase access to underserved markets, optimise risk selection, and reduce premium volatility.

We provide a workbench as just one part of the toolkit, allowing carriers to process and structure all received data to the necessary standards for use downstream. But there is much more beyond that.

Smart Underwriting lets underwriters manage teams, workflow allocation and sign-offs in one pane of glass. Our human-in-the-loop technology keeps underwriters and brokers fully informed of all policy changes.

Use Artificial’s platform to launch a fully digital underwriting product, with integrated pricing and portfolio management, in 4-6 weeks.

Whether carriers are writing lead business, following at scale, or managing shared capacity through consortia, Artificial’s Smart Underwriting supports the full spectrum of strategies:

Smart Lead enables faster, data-enriched lead decisions, giving underwriters full visibility across their portfolio and the ability to steer intelligently and make well-informed decisions.

Smart Follow automates appetite-based decision-making for follow business, supporting both algorithmic and manual triage, with clear audit trails and referral controls.

Smart Consortia streamlines the creation and oversight of digital consortia, helping carriers manage delegated authority without the usual friction.

Smart Portfolio provides real-time insight into portfolio performance, enabling carriers to monitor exposures, optimise capital deployment, and adapt appetite dynamically in response to market conditions.

Smart Delegated digitises delegated authority operations from end to end, automating data capture, triage and compliance checks, and giving carriers complete oversight, governance and control of binder performance.

Underwriting isn’t an administrative job, so why treat it that way?

Over the past five years, we’ve seen huge investment in data quality, infrastructure and digitisation.

Indeed, the LMA report notes that continued investment in technology, data integration, and strategic frameworks will be essential for scaling enhanced underwriting innovations effectively across the market.

The foundations are certainly there, but the next step is to use these to rethink how underwriting is actually performed, not just how it’s administered.

The difference between Smart Underwriting and an underwriting workbench is fundamental: workbenches help underwriters execute what’s already been decided, while Artificial’s Smart Underwriting platform helps carriers build and execute underwriting strategies with data, rules and oversight built in.

In a market where margins are under pressure and broker strategies are becoming more sophisticated, that distinction matters. Carriers need to scale intelligently, respond quickly, and maintain control. Doing that well requires more than just a workbench.

The carriers who act now will set the pace, but those who wait risk being constrained by tools designed for yesterday’s market.

If you want to move beyond workflow efficiency and start underwriting with true strategic control, we can help you get there in weeks, not years.

Speak to our team about building an enhanced underwriting platform tailored to your appetite, processes, and growth ambitions.