EBITDA: The bottom line for brokers

The end-to-end placing process is fragmented, often involving duplicated data entry and multiple administration systems such as Policy, Claims, Bordereaux and e-trading platforms.

Invariably, this means that individual brokers have to spend too much time on administration rather than executing the primary function of their role and increasing their EBITDA - the bottom line.

“The average London market broker spends 57% of their time completing administrative tasks.”

The Future of Commercial Insurance Broking, Chartered Insurance Institute

This creates two critical headwinds for insurance brokers:

The cost base for placing business is unnecessarily high, which negatively affects their EBITDA

A lack of control over data makes it difficult to add value to underwriters and differentiate from the competition

But we believe the right technology gives brokers the opportunity to do things differently.

An opportunity for brokers

The digital transformation of insurers has already begun and we predict this will accelerate over the next 18 months.

A vast opportunity exists for digitally-enabled brokers to meet the needs of both the new kind of digital insurer and an evermore demanding client base - and reap the countless benefits for themselves, too.

As John Moore MBA, Immediate Past President of the CII, puts it:

"The way forward for any individual or firm in the market is to relentlessly focus on clients and to continuously develop skills and technologies to support clients even further. This is the route to a successful and vibrant profession and to creating a future for the people working within broking both today and in the future.”

What does an optimised digital broker look like?

A connected ecosystem

In order to connect with the next generation of insurers, brokers need tools that are fit for purpose: a fully digital toolkit that meets the needs of an efficient, profitable and forward-thinking brokerage.

The ideal toolkit should be synced across the organisation: data is structured as it flows into the platform and is usable across different functions - from contract creation to placing - and flows through to post-bind activities such as invoicing and bureau submission.

Throughout the process data can be easily shared with the wider ecosystem, such as PPL. In return, this technology delivers increased profitability and efficiency - increasing EBITDA.

A platform designed with brokers in mind

Artificial facilitates an efficient, digital process by providing key technology where it is needed the most along the insurance value chain.

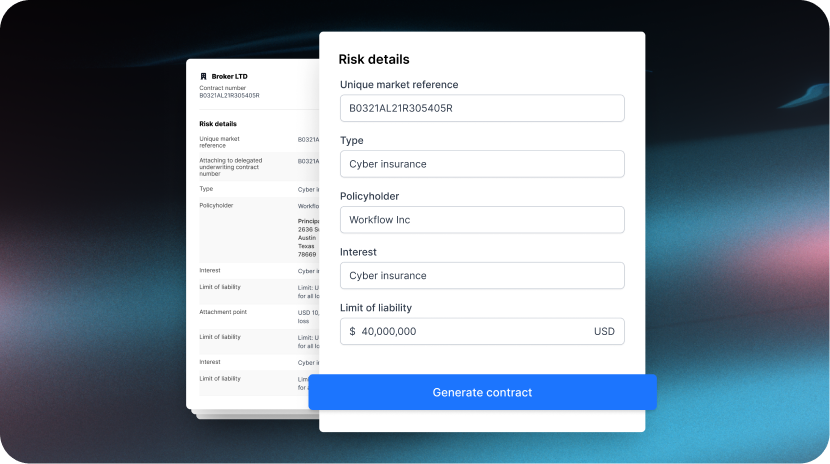

Our platform allows brokers to combine their risk structure, data points and legal documents with powerful editing and formatting capabilities for a streamlined insurance workflow.

1. Submission

Gone are the days of spending hours digesting the varied and complex policyholder information to send to underwriters: accurate data ingestion and the creation of structured data at the start of the journey lays the foundation for a streamlined placement process, from building digital contracts through to post-bind activities.

Often the data required to make key underwriting decisions does not form part of the core information required to create a compliant contract of insurance (e.g. is a given property in a high peril zone?). So being able to collect relevant additional data by providing it from internal sources or using third parties is key to enable efficient decision making.

2. Digital contract builder

Underwriters of the future will rely on brokers to provide well-structured risk data. Artificial allows brokers to create structured digital contracts that integrate with wording libraries to enable the seamless flow of data to underwriters and other target systems.

By building market standard contracts in a data-first, digital way, brokers can use the data to make their own operations more efficient whilst also providing considerable additional value to their underwriting partners and policyholders.

3. Automatic decision making

Brokers can get ahead by immediately generating a proportion of total capacity with an individually defined appetite from a panel of underwriters who are integrated with the Artificial platform.

Submissions are triaged within seconds and can be accepted and priced almost instantly, providing an unprecedented level of customer service to the policyholder.

Real results

We’re working with leading Lloyd’s brokers to improve their EBITDA and profitability across multiple product lines. Our platform has yielded efficiencies and improved performance already:

75% reduction in time taken to quote, bind and issue a policy

19% increase in revenue through introduction of digital distribution

90% reduction in processing costs of complex submissions

The next generation of broking is here - so why not join us?